Capitalize On Analytics

Alternative Assets

Alternative Diversification

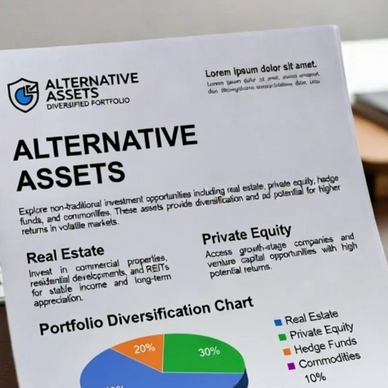

Alternative Assets

By leveraging advanced analytics and proprietary models, the firm enables clients to optimize portfolio diversification, assess risk-adjusted returns, and unlock long-term growth potential in non-traditional investment classes.

Private Credit

Alternative Diversification

Alternative Assets

Capital Business Analytics leverages sophisticated data modeling and market intelligence to evaluate private credit opportunities, helping investors assess credit quality, portfolio diversification benefits, and potential for superior returns compared to traditional fixed income.

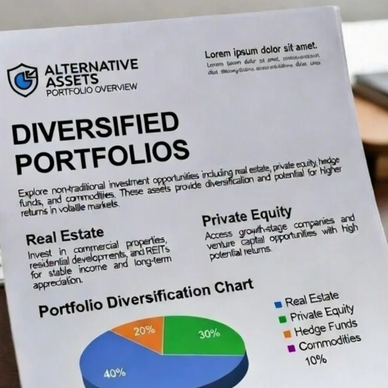

Alternative Diversification

Alternative Diversification

Alternative Diversification

Capital Business Analytics employs advanced data analytics and scenario modeling to design and optimize diversified portfolios, enabling clients to capitalize on uncorrelated opportunities, mitigate volatility, and align allocations with their specific risk tolerance and growth objectives.

Contact Us

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.